Welcome To Smartperson Financial

ELITE CREDIT ADVANCEMENT SOLUTIONS

Improving your credit health is one of the

most important financial decisions you can make.

Your credit affects interest rates, approvals, and access to real opportunities—yet most people don’t know what’s on their report or how it’s holding them back.

Credit restoration gives you clarity, corrects damaging inaccuracies, and strengthens your ability to move toward ownership, financing, and long-term financial stability!

Personal Credit

Working on your credit health? Have you applied for a car or a home and got denied? Trying to qualify for major funding and build real financial power? You’re in the right place.

Personal credit is more than a score — it’s a gateway to leverage, freedom, and generational opportunity. At Smartperson Financial, we guide you in advancing your credit health as a critical step toward building lasting wealth.

Business Credit

Own an LLC but struggling to attract consistent clients? Trying to scale but lack the working capital to take the next step? Let's position your business to access $50K–$250K in funding to grow with precision and purpose.

Business credit is a great resource — but it starts with how you position yourself personally. We help you strategically leverage your personal credit to access $50,000 to $250,000 in high-limit business funding at 0% interest for up to 18 months, giving your business the capital and confidence to scale.

--------- Why is Your Credit Important? ----------

THESE ARE THE FACTS!

CREDIT POSITIONING

Your credit profile determines how you’re viewed by lenders, partners, and institutions. Strong positioning allows you to access funding, negotiate terms, and expand with confidence.

ACCESS TO CAPITAL

Good credit creates access to significant, low-cost capital through personal and business funding channels. This unlocks growth opportunities that would otherwise be delayed or denied.

INCREASED BUYING POWER

Whether you're financing a home, vehicle, or asset, strong credit improves your purchasing ability and reduces dependency on high-interest or cash-only solutions.

GOODBYE TO HIGH RATES

You shouldn’t be paying 20%+ just to borrow money. Better credit puts you in the driver’s seat with lower rates, better offers, and more leverage in your decision.

Over time, this saves you thousands and keeps more capital available for investments.

DEBT OPTIMIZATION

High credit health allows you to refinance or restructure existing obligations under better terms — improving your cash flow and reinforcing your long-term financial position. This creates flexibility for future planning, lending, and investment decisions.

VERIFIED CREDIBILITY

A strong credit profile enhances how you're perceived not only by lenders, but also by employers, partners, and institutions. It reflects responsibility, stability, and readiness — qualities valued in both business and career advancement.

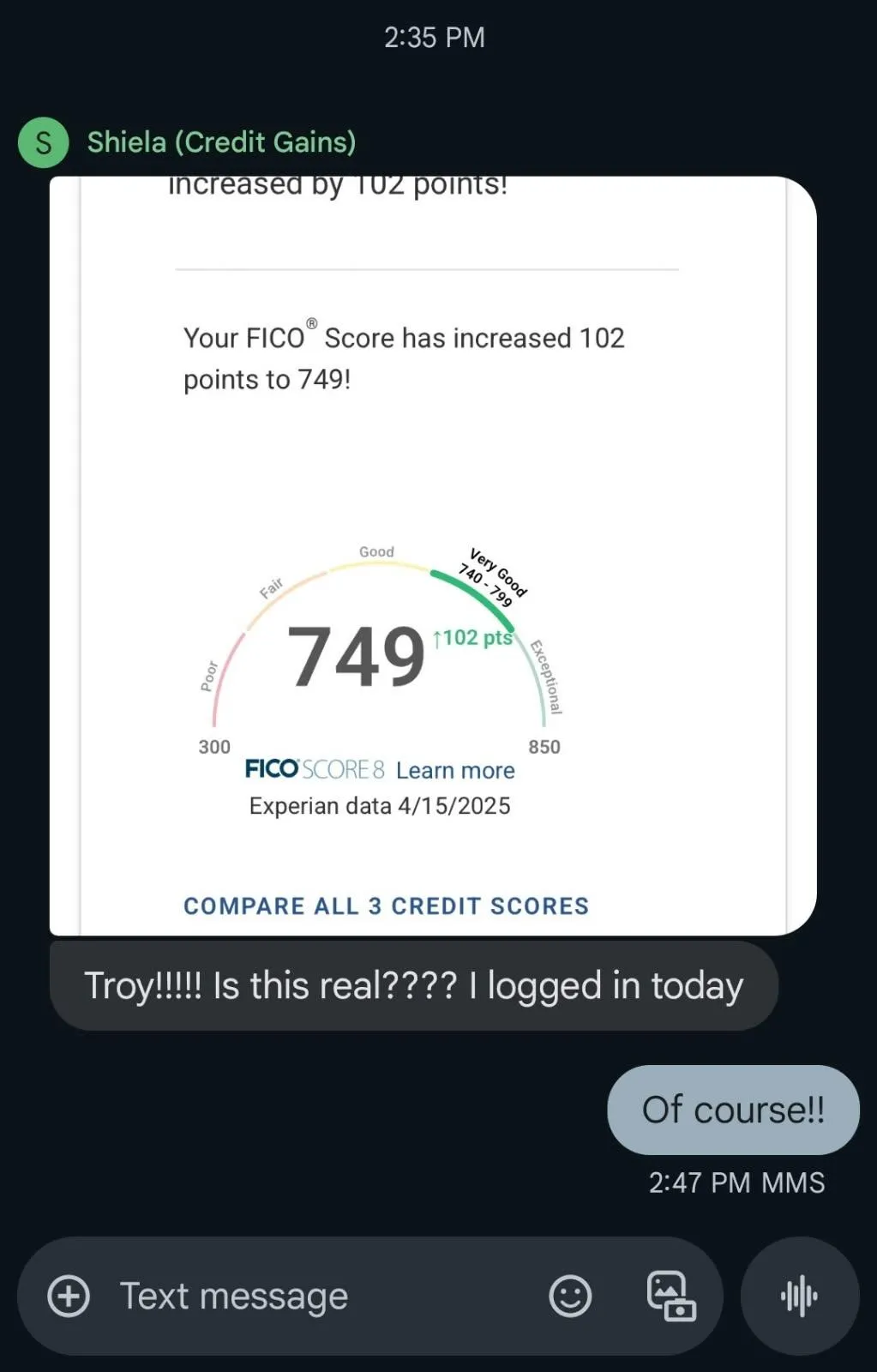

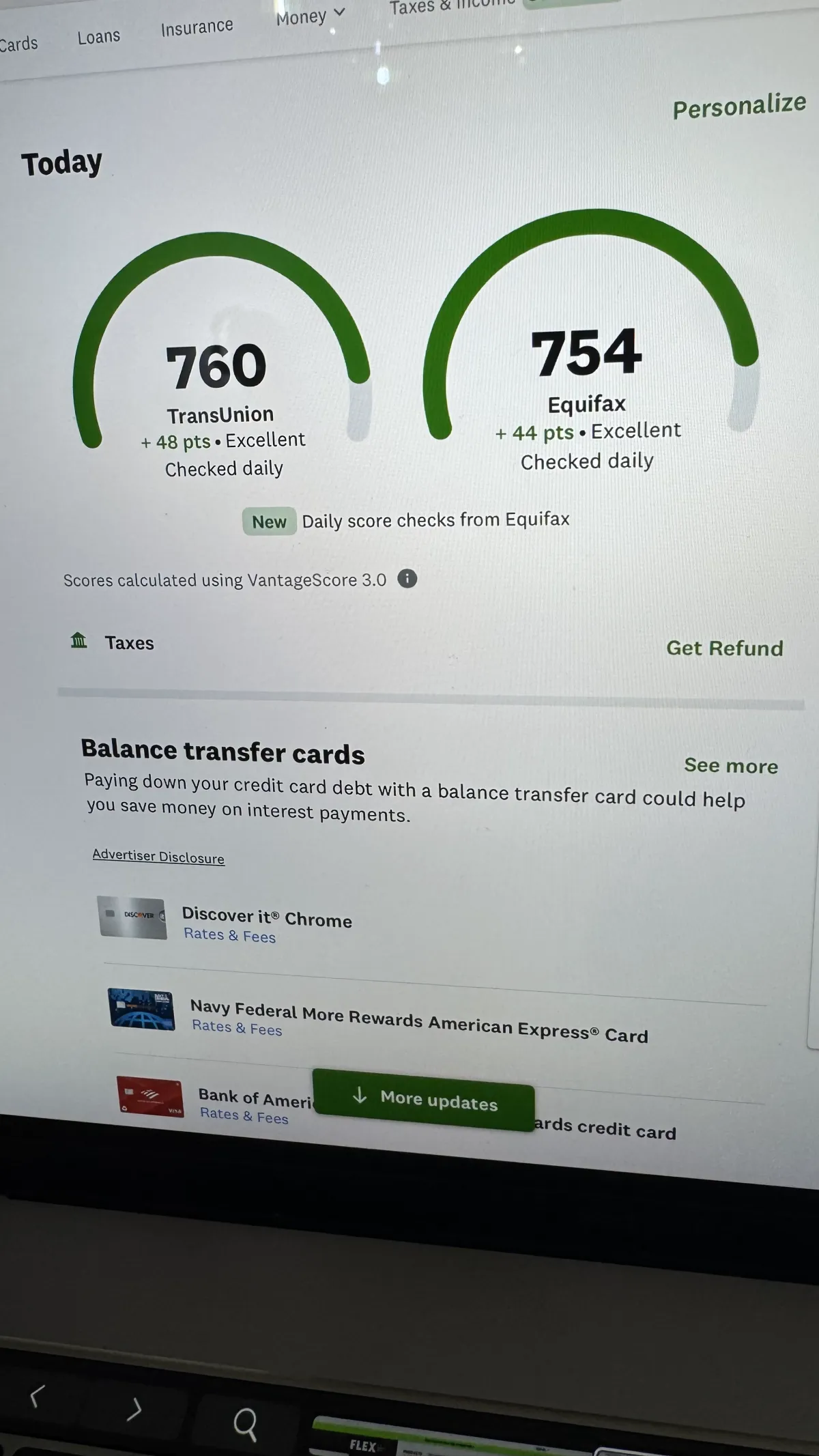

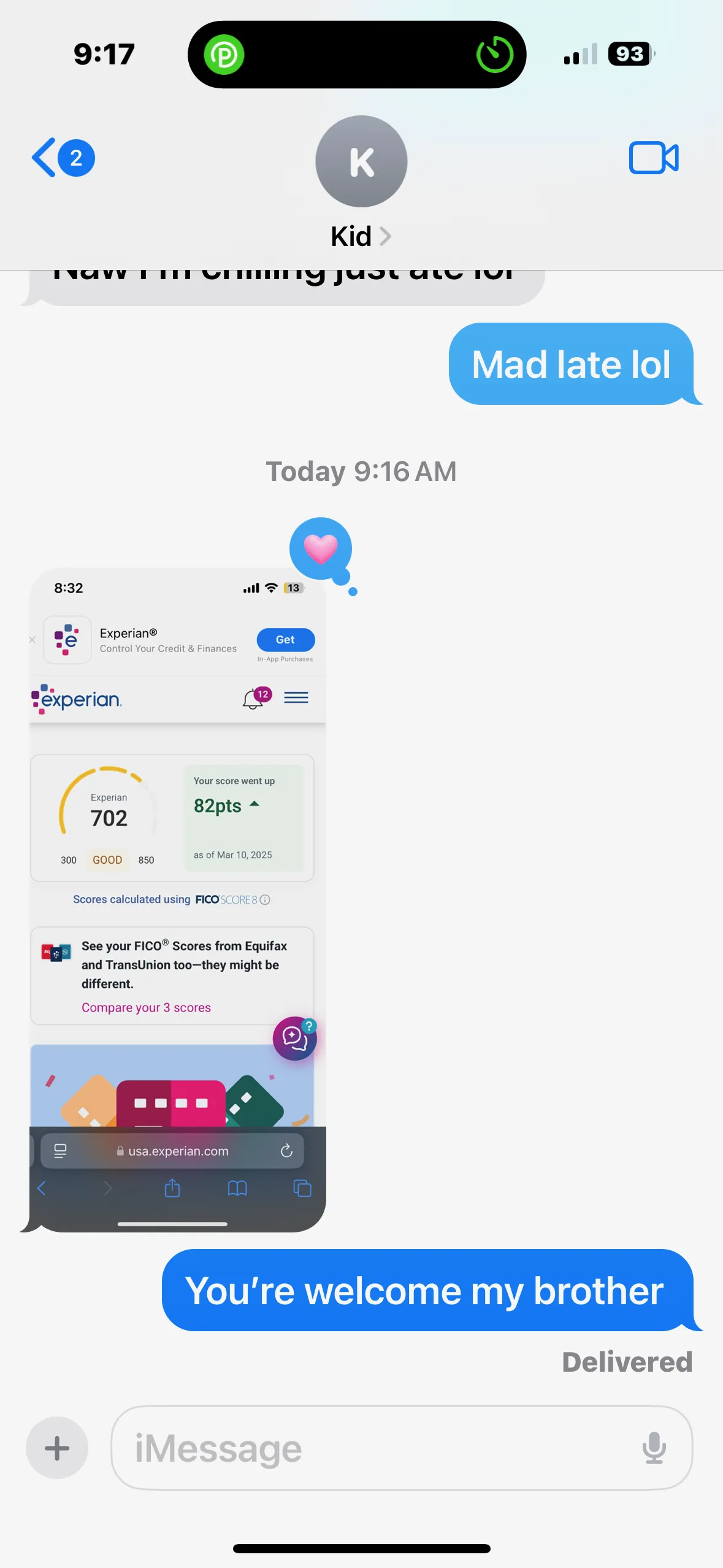

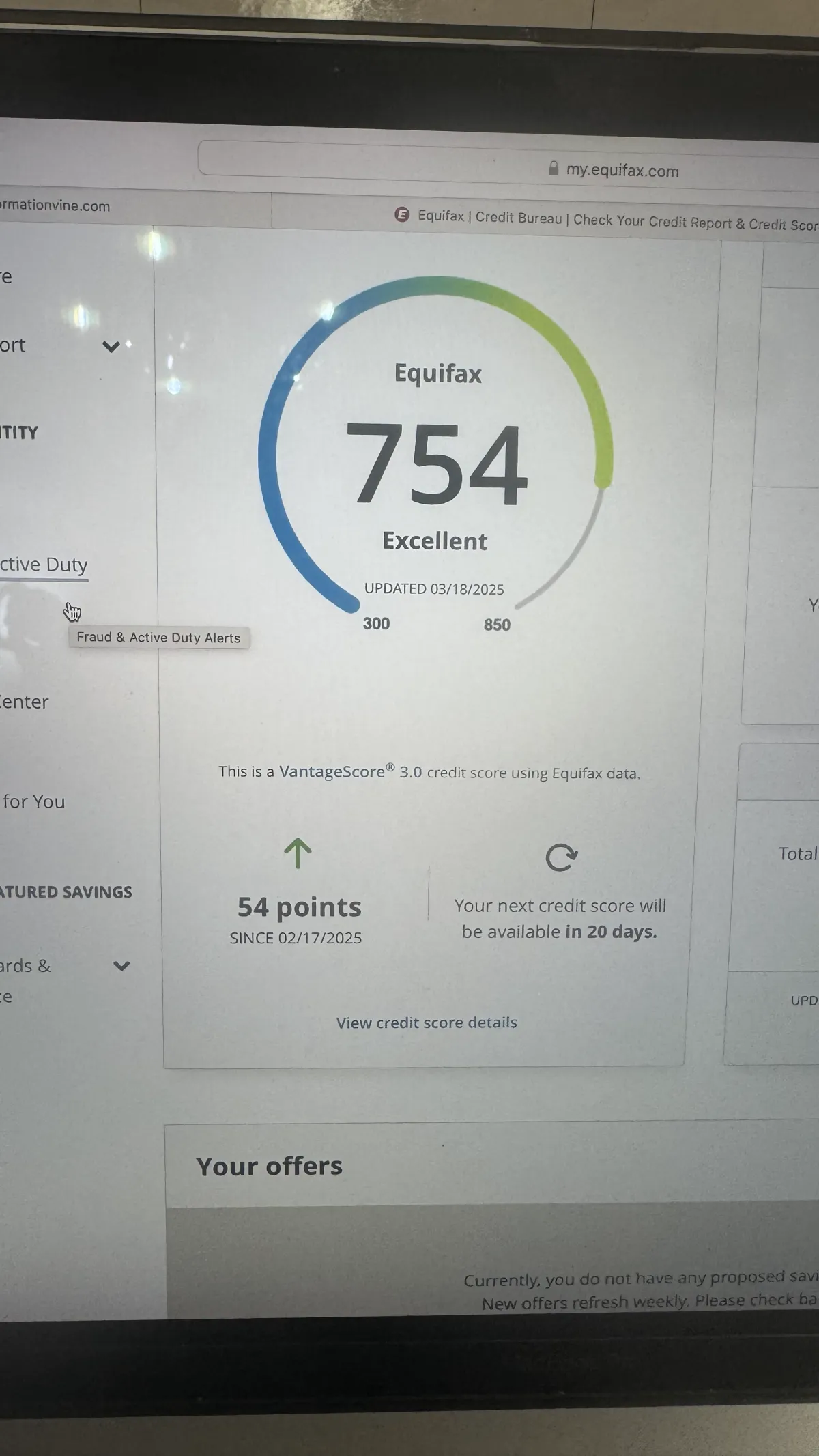

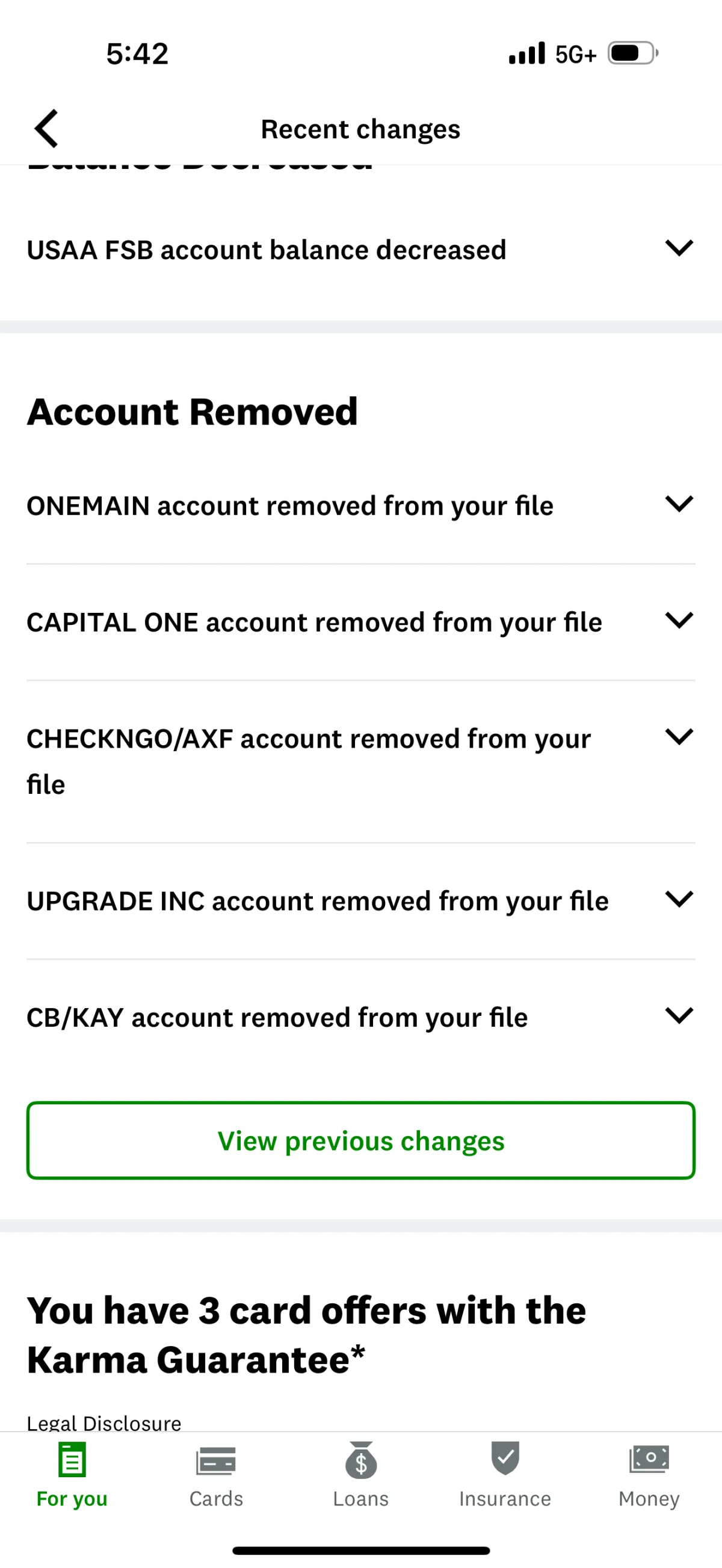

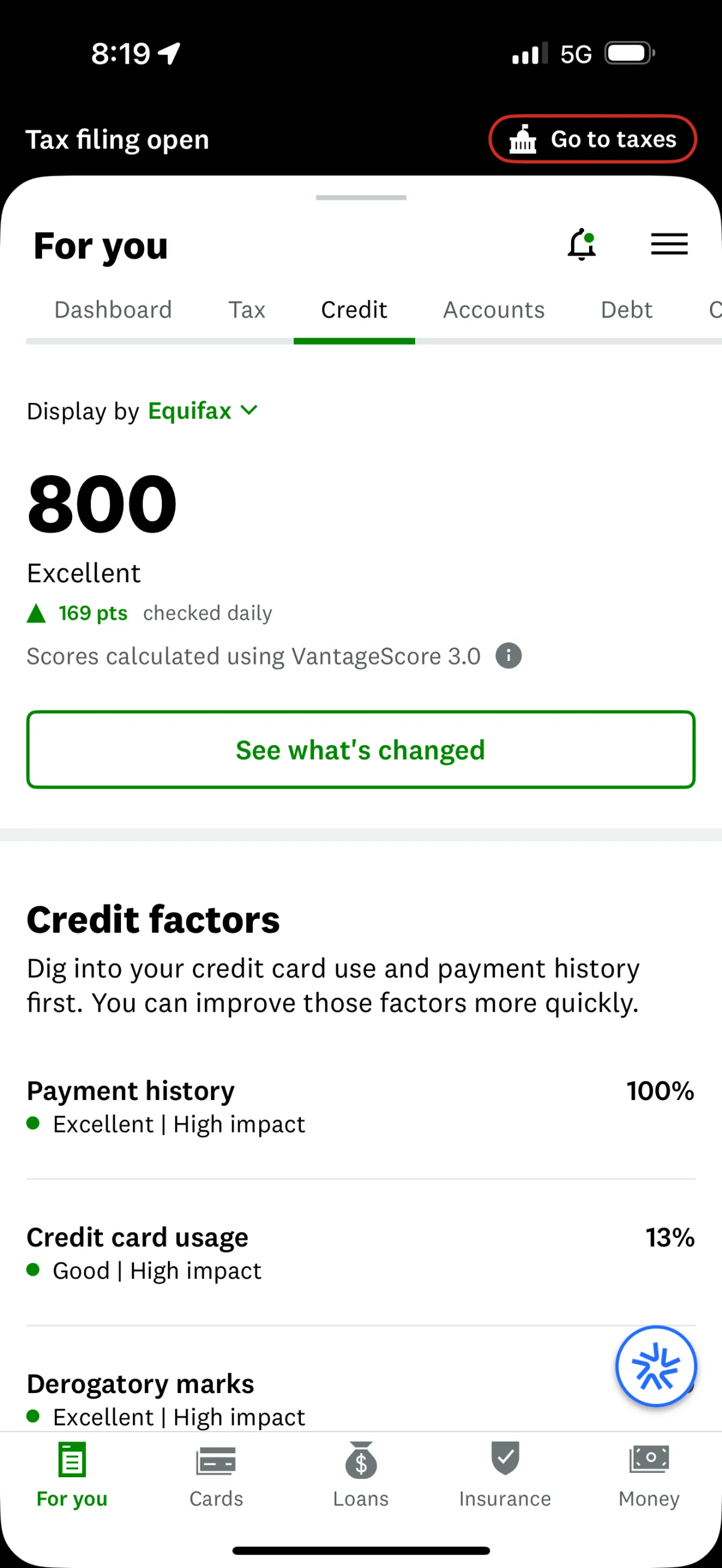

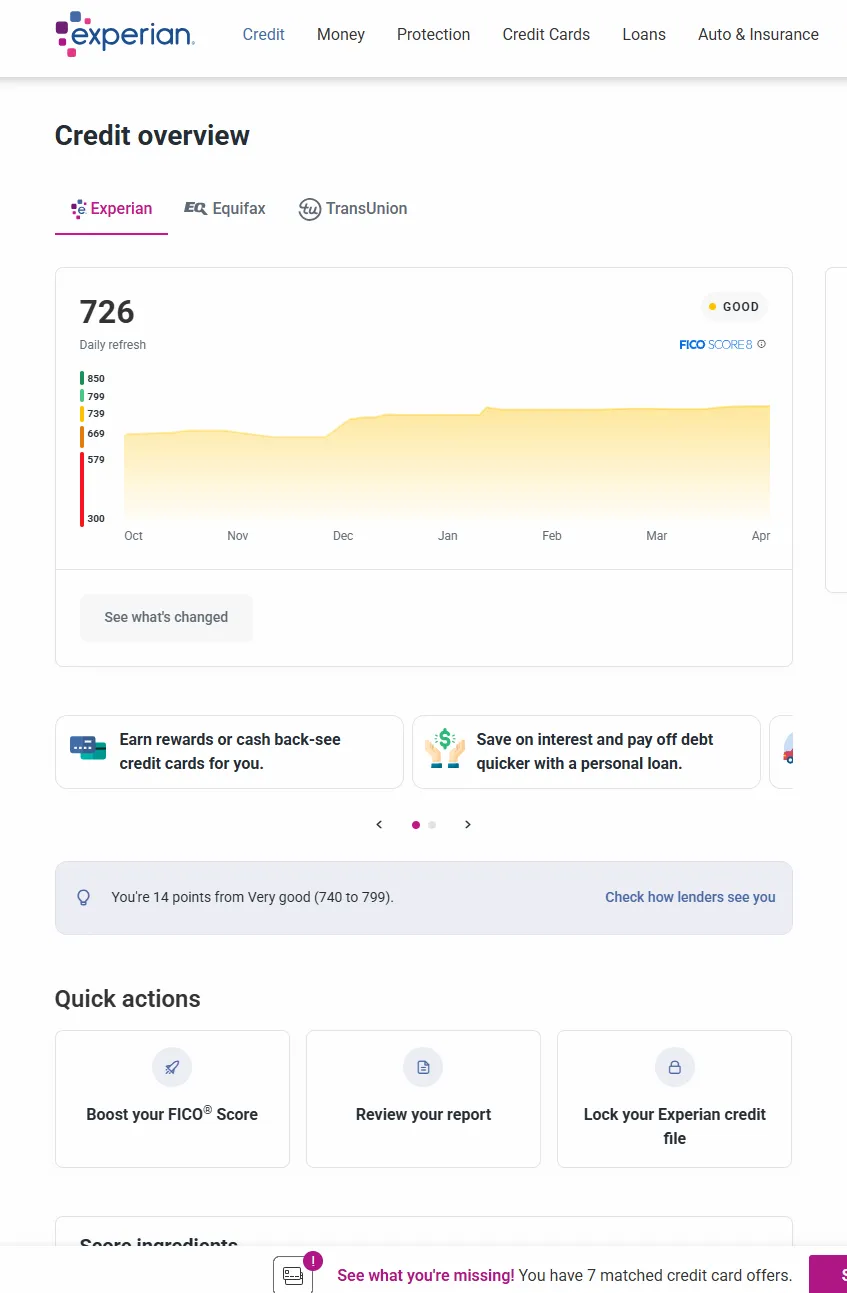

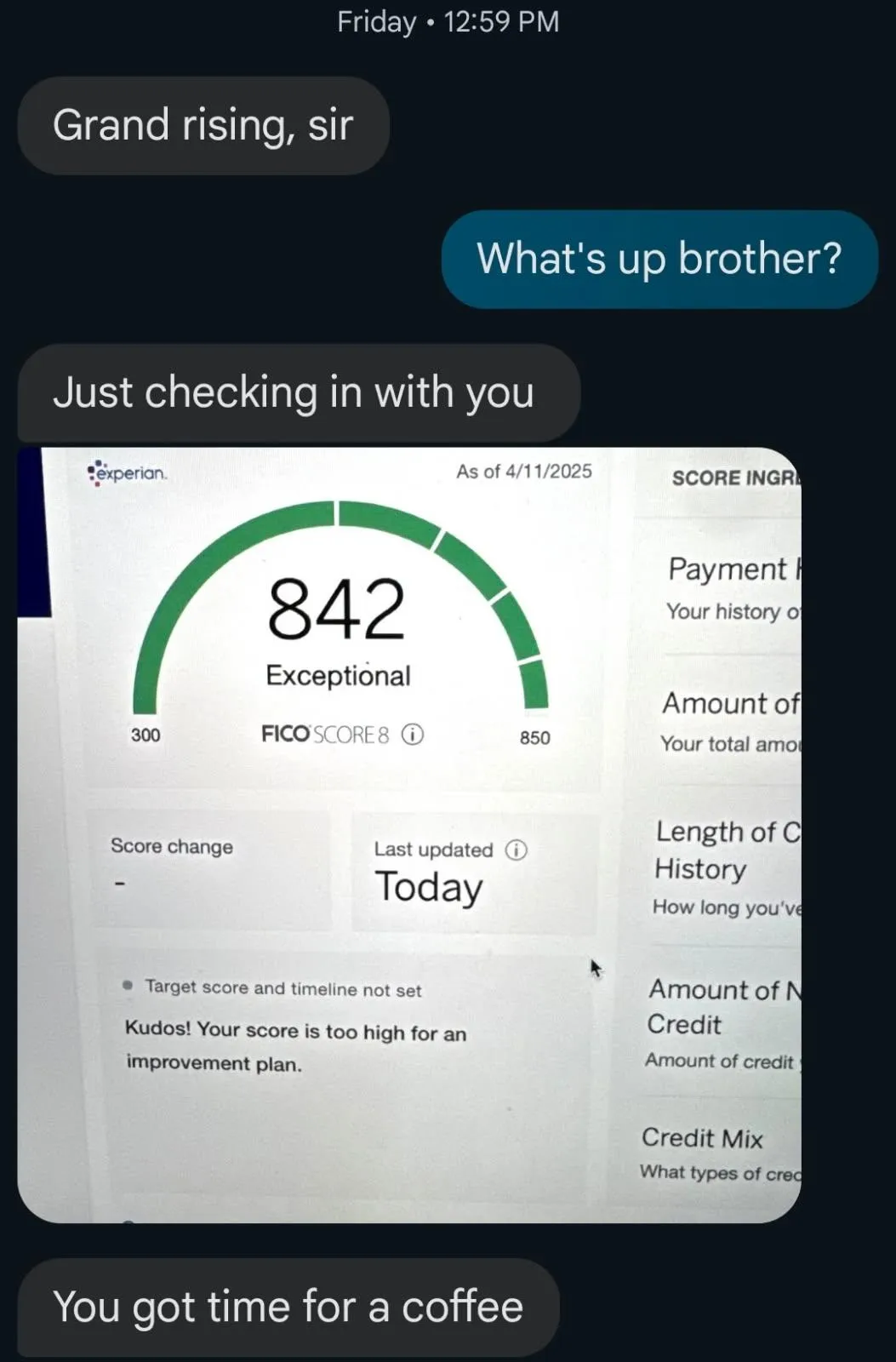

Happy Clients!

We Let the Results Speak for Themselves

Office: 447 Broadway,

2nd Floor #1058

New York, NY 10013

Email Support : [email protected]